Our approach

- Nova Finance

- Our Approach

About us

We are a team of portfolio managers and investment advisors with a wide range of experience and a set of shared values that define our relationships with our clients and our approach to wealth management. We all share the same commitment to openness, dedication and discipline, as embodied in our four fundamental qualities.

Listening and working together

We take the time to listen to you and have real conversations with you, so we understand your specific needs and the life you want to build for you and your family. We believe that’s the foundation for a constructive long-term relationship.

Independence

We have the freedom to act independently, meaning we can choose the solutions that are best suited to your needs.

A holistic approach

We’ll

guide you through a rigorous analysis of your financial and personal goals to

help you build a solid and comprehensive wealth management plan.

Transparency

We

strive to earn your trust every day through our unwavering commitment to

integrity and openness.

A long-term vision

Foundations of our investment philosophy

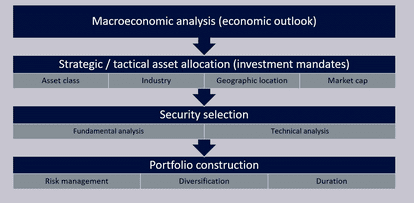

Our investment philosophy is grounded in patience and discipline aimed at growing our clients’ wealth over the long term. When making decisions, we consider factors like macroeconomic and monetary policy and our strategists’ forecasts. Through internal and external research and the support of our investment committee, we select high-quality securities that have solid fundamentals.

When building portfolios, we apply strategic and tactical asset allocation tailored to the specific needs of our clients.

Our well-balanced portfolios are diversified by asset class, industry and geographic location.

Portfolio construction

Components of the investment process

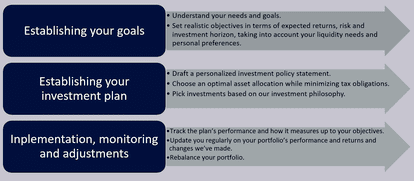

To help you grow your money effectively over the long term, we need to get to know you well. To do this, we use the following process:

Investment mandates

Income

- You want to strike a balance between capital preservation and maximizing your portfolio’s income potential.

Balanced

- You want to strike a balance between income and growth potential and your ability to accept market downturns.

Balanced Growth

- You want to strike a balance between income and growth potential and you are willing to take on some additional risks to achieve greater capital appreciation in the long term.

Growth

- You want to focus primarily on growing your capital in the long term.

High Growth

- You want to focus exclusively on growing your capital in the long term and you recognize that this can expose you to more significant short-term gains or losses.